Multiemployer Pension Reform Act of 2014 Zone Status Changes

The Multiemployer Pension Reform Act of 2014 is part of the omnibus budget bill, which was signed by President Obama on December 16, 2014. The bill makes a number of changes to the funding rules applicable to multiemployer plans and permanently removes the sunset date that would have otherwise applied to the provisions pertaining to the "zone status" of plans and the automatic 5-year extension of amortization periods.

Our Pension Alert of December 11, 2014 summarized some of the highlights of the law. This alert will be the first of several that will take a closer look at changes in the law and their potential effect on multiemployer plans.

Changes in Actuary's Certification of Zone Status

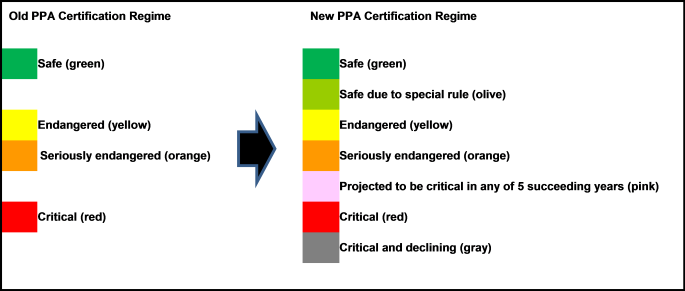

An important change that will impact the application of many other provisions is the new requirement for the actuary's annual certification of a multiemployer plan's status (often referred to as being in the "yellow," "red," or "green" zones). In the past, a plan could be endangered ("yellow zone"), critical ("red zone"), or neither endangered nor critical ("green zone"). The new law, beginning with the 2015 plan year, requires the actuary to certify whether the plan is in one of seven categories as shown in the following table.

Effect of New Categories for Certification

Each of the possible certification categories carries with it different consequences. The following table shows what happens under each category. Old law refers to the law prior to passage of the new bill, while new law refers to the changes under the new bill.

Effect

of New Categories for Certification

Each

of the possible certification categories carries with it different

consequences. The following table shows

what happens under each category. Old

law refers to the law prior to passage of the new bill, while new law refers to

the changes under the new bill.

|

Category |

Impact |

|

Safe (green) |

Same as green status

under old law |

|

Safe due to special

rule (olive) |

Notice to bargaining parties and PBGC but no other

action required |

|

Endangered (yellow) or

Seriously Endangered (orange) |

No change, still

requires development of a funding

improvement plan, and notice to participants and others |

|

Projected to be

critical in any of 5 succeeding years (pink) |

Notice to PBGC, plan

may elect to be critical (which then requires notice to participants) |

|

Critical (red) |

No change, still

requires development of a rehabilitation

plan, and notice to participants and others |

|

Critical and declining

(gray) |

Notice to

participants, plan is eligible to consider reducing benefits (see below) |

New Exception to Endangered Status - Projected Safe (olive)

The new law adds a new provision that applies if a plan would be endangered, but the plan actuary certifies that the plan is projected to no longer meet the conditions to be endangered (and thus are projected to be safe, i.e., "green") as of the end of the tenth plan year ending after the plan year to which the certification relates. Such a plan is not treated as endangered for the current plan year, provided that the plan was not in critical or endangered status for the immediately preceding year. Effectively, the change provides that a plan that is projected to be safe (green) in 10 years without any changes does not need to go through the trouble of developing a funding improvement plan.

For example, if a plan (with a calendar plan year) was safe (green) for 2014, the actuary certifies that the plan would otherwise be endangered (yellow) for 2015, and further certifies that the plan would be safe (green) at the end of 2025, then the plan would not be considered endangered (yellow) for 2015.

Projected to be Critical (pink)

The new category, projected to be critical, applies to a plan that would not otherwise be in critical status (red) for a plan year, but is projected by the plan actuary to be in critical status (red) in any of the five (5) succeeding plan years. In this situation, the plan sponsor may elect to be in critical status (red) for the current year. The election has to be made not later than 30 days after the plan actuary's certification for the year.

For example, if the plan actuary certifies that the plan is not in critical status (red) for 2015 but is projected to be in critical status (red) for 2020, the plan sponsor may elect (in the 30 day period) for the plan to be in critical status (red) for 2015. Then, 2015 would be considered the initial critical year, the trustees would need to develop a rehabilitation plan, and plan operations would be subject to the rules for plans that are critical (red) and the accompanying restrictions.

Critical and Declining for the Plan Year (gray)

Arguably, the new status that has the most consequences is the status of "critical and declining." Such plans are considered to be "deeply troubled" plans. Reductions in normal retirement accrued benefits and benefits of retirees in pay status, which have received much press coverage, can be made only for a plan that is in critical and declining status.

A plan in critical status is considered to be in critical and declining status if the plan is projected to be insolvent during the current plan year or any of the 14 succeeding plan years. However, if the plan has a ratio of inactive participants to active participants that exceeds two to one, or if the funded percentage is less than 80 percent, then the period for projected insolvency is 19 years instead of 14 years.

A plan that is in critical and declining status cannot simply reduce accrued benefits. A reduction in benefits under the new law requires that the plan sponsor amend the plan to bring about such reduction. There are many factors to be considered and limitations that apply in taking such a step. Furthermore, there is a prescribed process that must be followed to get approval for a reduction in benefits. The limitations, considerations, and process will be the subject of a subsequent alert.

Cheiron pension consultants can assist you in analyzing the impact of the new law and the new categories for certification of status.

Cheiron is an actuarial consulting firm that provides actuarial and consulting advice. However, we are neither attorneys nor accountants. Therefore, we do not provide legal services or tax advice.